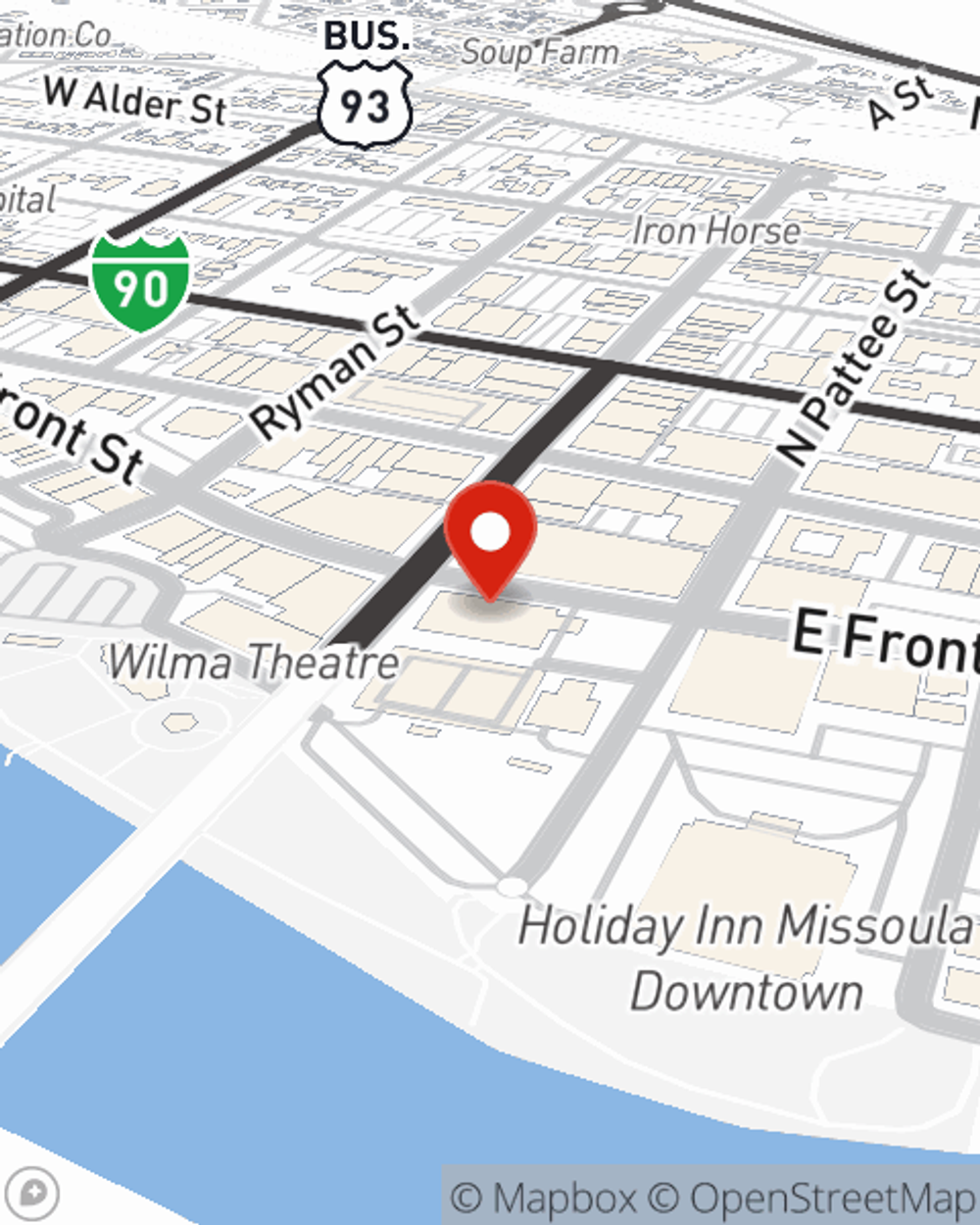

Homeowners Insurance in and around Missoula

Looking for homeowners insurance in Missoula?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance covers more than your home. It protects both your home and your precious belongings. If you experience vandalism or a tornado, you may have damage to the items in your home beyond damage to the home itself. Without adequate coverage, you may struggle to replace all of the things you lost. Some of your belongings can be protected from theft or loss outside of your home, like if your bicycle is stolen from work or your car is stolen with your computer inside it.

Looking for homeowners insurance in Missoula?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Agent Misti Svoboda, At Your Service

Preparing for life's troubles is made easy with State Farm. Here you can construct a personalized policy or submit a claim with the help of agent Misti Svoboda. Misti Svoboda will make sure you get the considerate, excellent care that you and your home needs.

Ready for some help getting started on a homeowners insurance policy? Get in touch with agent Misti Svoboda's team for assistance today!

Have More Questions About Homeowners Insurance?

Call Misti at (406) 552-0730 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Weatherproofing: how to prepare for a heat wave

Weatherproofing: how to prepare for a heat wave

As the summer approaches, it’s critical to consider how to prepare for extreme heat. We’ll discuss heat safety tips for your home and vehicle.

How to prevent pipes from freezing

How to prevent pipes from freezing

Frozen pipes can cause significant water damage in your home. State Farm provides ways to help prevent frozen pipes, and how to deal with burst pipes.

Misti Svoboda

State Farm® Insurance AgentSimple Insights®

Weatherproofing: how to prepare for a heat wave

Weatherproofing: how to prepare for a heat wave

As the summer approaches, it’s critical to consider how to prepare for extreme heat. We’ll discuss heat safety tips for your home and vehicle.

How to prevent pipes from freezing

How to prevent pipes from freezing

Frozen pipes can cause significant water damage in your home. State Farm provides ways to help prevent frozen pipes, and how to deal with burst pipes.